A Wake-Up Call for 2026 Budget Planning — Cap-and-Trade Is Far More Forceful Than the Carbon Fee

With Taiwan’s carbon fee scheduled to take effect in 2026, corporate finance and accounting teams are facing unprecedented budgeting challenges. Yet the truly disruptive factor is not the price per ton of emissions, but the highly probable introduction of a cap-and-trade system in the near future.

Cap-and-trade not only imposes a strict limit on total corporate emissions but may also trigger carbon credit scarcity and soaring compliance costs—directly constraining production scale and eroding profitability. This article examines the potential impact of cap-and-trade and explores how companies can adopt financial strategies to optimize capital expenditure in advance, turning emerging risks into strategic assets.

Cap-and-trade not only imposes a strict limit on total corporate emissions but may also trigger carbon credit scarcity and soaring compliance costs—directly constraining production scale and eroding profitability. This article examines the potential impact of cap-and-trade and explores how companies can adopt financial strategies to optimize capital expenditure in advance, turning emerging risks into strategic assets.

1. Professional Financial Accounting and the Estimation of “Carbon Cost as Liabilities” Under Cap-and-Trade

Under a cap-and-trade framework, companies are allocated a fixed amount of emission allowances. Once actual emissions exceed the allocated quota, the company must purchase additional carbon credits on the market to offset the excess. This mechanism introduces two significant accounting and financial impacts on corporate reporting:

(1) Recognition of Potential Liabilities

Emerging accounting standards increasingly classify environmental obligations as corporate responsibilities. When a company anticipates that its emissions will exceed its allocated allowances, the excess portion effectively becomes a form of potential environmental liability. Finance teams should refer to international sustainability disclosure standards—such as IFRS S2—to estimate the future cost of acquiring carbon credits in advance and incorporate these estimates into both budget planning and the notes to financial statements.

(2) Increasing Complexity in the Accounting Treatment of Carbon Credits

Carbon credits (allowances) acquired to fulfill environmental obligations are not automatically classified as simple assets. Their final accounting classification—whether as intangible assets, inventory, or expenses—depends on their purpose and nature of acquisition. Professional advisory firms note that incorrect classification may not only lead to overstated assets or understated current-period expenses, but may also affect how banks assess a company’s risk profile during green financing reviews.

Image source: FREEPIK

2. Decision-Making Tools in the Carbon-Fee Era: The MAC Model and Practical Approaches to CAPEX Optimization

As carbon costs increasingly take the form of liabilities, every capital expenditure (CAPEX) must be reassessed through a financial and strategic lens. CAPEX is no longer a simple “procurement” decision—it has become a strategic investment that will determine a company’s future competitiveness.

To ensure that every dollar is spent where it matters most, companies can adopt the Marginal Abatement Cost (MAC) model as a core tool for evaluating the effectiveness and financial value of decarbonization projects.

To ensure that every dollar is spent where it matters most, companies can adopt the Marginal Abatement Cost (MAC) model as a core tool for evaluating the effectiveness and financial value of decarbonization projects.

2.1 The MAC Model: A Calculator for the “Cost-Performance Ratio” of Decarbonization Investments

The Marginal Abatement Cost (MAC) model is a tool for calculating the cost-effectiveness of decarbonization projects. Its core concept is simple:How much does a company need to spend to reduce one metric ton of CO₂e?

- Practical Example: If Project A has a MAC value of NT$500/ton and Project B has a MAC value of NT$1,500/ton, then—even if both projects require the same total investment—Project A is clearly the smarter choice. It achieves greater emission reduction efficiency at a lower cost.

- Decision Recommendation: Companies should prioritize projects with the lowest MAC values. Doing so maximizes carbon-reduction efficiency per dollar of CAPEX and minimizes future costs associated with carbon-fee payments or the purchase of additional carbon credits when emissions exceed allocated limits.

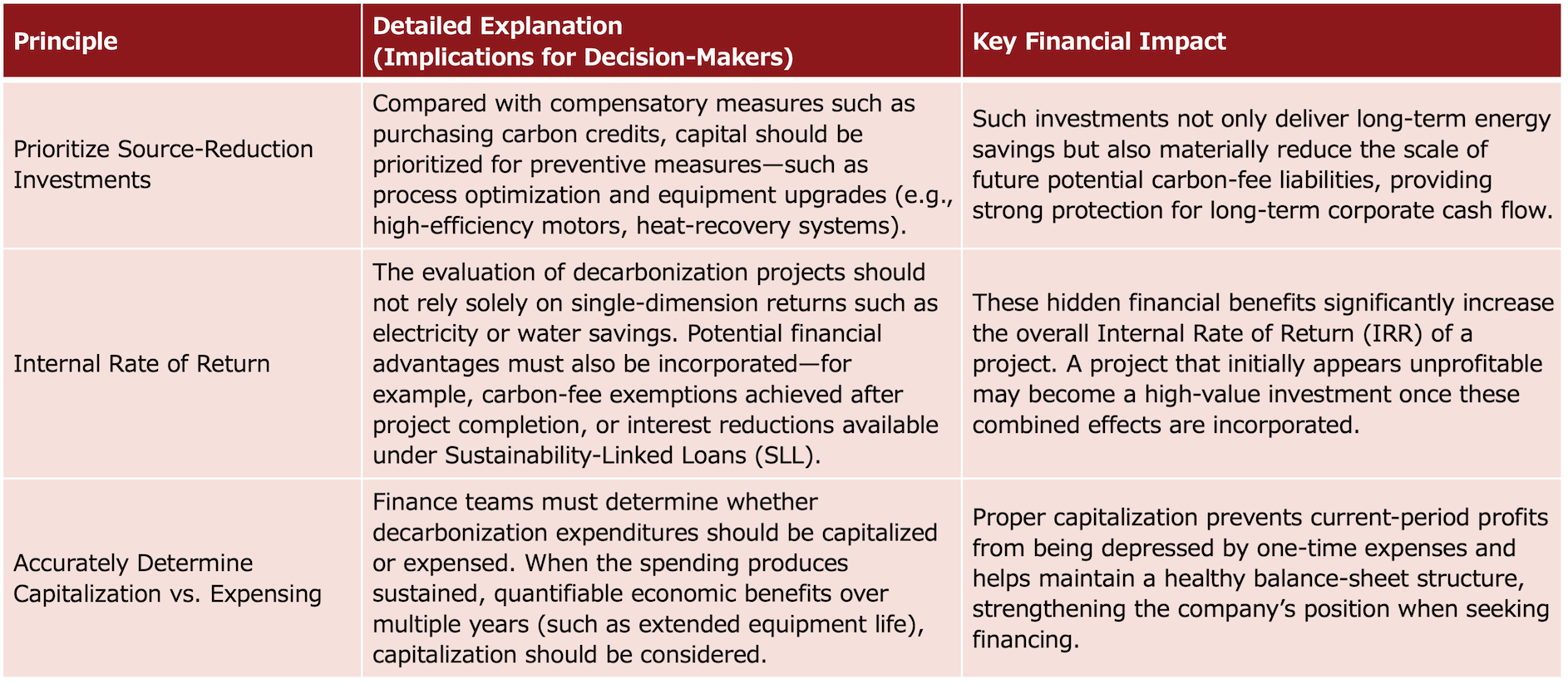

2.2 Three Golden Principles for Optimizing CAPEX: Shifting from a Cost Center to a Profit Center

When evaluating decarbonization investments, companies must move beyond the traditional mindset of treating them merely as “environmental expenses.” Instead, such investments should be viewed as levers for enhancing overall financial performance.

The following are the three golden principles that finance departments should follow when planning CAPEX:

The following are the three golden principles that finance departments should follow when planning CAPEX:

3. Conclusion: Practical Guidelines for Integrating ESG Governance into Budget Planning

The year 2026 marks a pivotal moment for corporate transformation in Taiwan. Successful transformation must begin with budget governance. Elevating ESG strategies from “environmental department spending” to company-wide financial decision-making is essential for staying ahead in the global net-zero transition. To ensure that ESG strategies are effectively embedded into operations, companies may adopt the following practical guidelines:(1) Establishing a “Carbon Cost Center” System: Linking Emissions to Operating Costs

- Practical Significance: Historically, electricity usage and emission data were managed by administrative or EHS departments and were disconnected from actual operating costs. In the carbon-fee era, the finance department should take the lead in linking carbon emissions to each department’s actual output and cost structure.

- Decision-Making Value: This approach motivates production, logistics, and other operational units to proactively seek decarbonization opportunities, as their carbon footprint will directly influence their budget performance. Through internal carbon pricing, companies can drive organization-wide behavioral change far more effectively—and with greater enforceability—than traditional policy communication alone.

(2) Conducting Scenario and Sensitivity Analysis: Building Safeguards Against Future Risks

- Practical Significance: Because future carbon-fee rates—and potential cap-and-trade allowance levels—remain uncertain, finance teams should not rely on a single assumed rate when preparing budgets.

- Decision-Making Value: Companies should conduct sensitivity analyses and scenario simulations using low, medium, and high carbon-fee assumptions. This enables decision-makers to clearly understand the potential impact on profitability and net cash flow under the worst-case scenario. Such an early-warning mechanism is an essential risk management tool in modern corporate governance.

(3) Ensuring Consistency of “Audit-Grade Data”: Strengthening the Foundation of Financial Trust

- Practical Significance: ESG data used for green-financing applications, carbon-inventory reports submitted to environmental authorities, and disclosures in financial-statement notes must be fully aligned and traceable.

- Decision-Making Value: This consistency is the foundation for earning market trust and securing the advantages of green financing. International standards such as ISSB require ESG information to meet audit-level rigor, equivalent to financial reporting. By establishing a single, reliable source of truth for ESG data, companies can prevent accusations of greenwashing caused by inconsistent disclosures and strengthen the evaluations of governance quality issued by rating agencies.

Image source: FREEPIK

Is your company ready to meet the new ESG challenges?

Fill out the ESG Financial Diagnostic Form to quickly understand your company's current ESG financial standing and receive tailored recommendations.

Hall Chadwick Taiwan has extensive experience in ESG financial consulting and can assist your company in building a sustainability reporting framework that aligns with the latest regulatory requirements.

If you have any questions regarding the 2025 ESG financial disclosure requirements, feel free to contact us.