A Comprehensive Analysis of Taiwan's 2025 ESG Regulations: Essential Checklist from Financial Reports to Carbon Reports

The year 2025 marks a critical milestone for Taiwanese enterprises in their journey toward sustainable development. The advancement of ESG (Environmental, Social, and Governance) regulations not only encourages companies to focus more on environmental protection and social responsibility but also profoundly impacts their business models and financial reporting practices. This article provides an in-depth analysis of Taiwan's 2025 ESG regulatory requirements, covering disclosure requirements from financial reports to carbon reports, and offers practical recommendations to help companies navigate challenges while seizing new opportunities.

1. Background of ESG Regulations and International Trends

1.1 Rapid Development of International ESG Regulations

As global climate change and environmental issues become increasingly severe, international organizations such as the United Nations and the Financial Stability Board (FSB) have been promoting sustainability reporting requirements for corporations. The International Sustainability Standards Board (ISSB), established in 2021, has released IFRS S1 and S2, setting standards for the disclosure of financially relevant sustainability data. These standards have also become a crucial reference for Taiwan's new ESG regulations.

1.2 Gradual Deepening of Taiwan's ESG Regulations

Taiwan has been implementing clear and proactive policies in the sustainability sector. From the 'Corporate Governance 3.0 - Sustainable Development Blueprint' to the 'Sustainability Roadmap for Listed Companies,' the regulatory framework has been gradually improved. In 2025, Taiwan will fully adopt IFRS S1 and S2, requiring companies to incorporate ESG-related information into their financial disclosures, demonstrating the country's commitment to aligning with international standards.

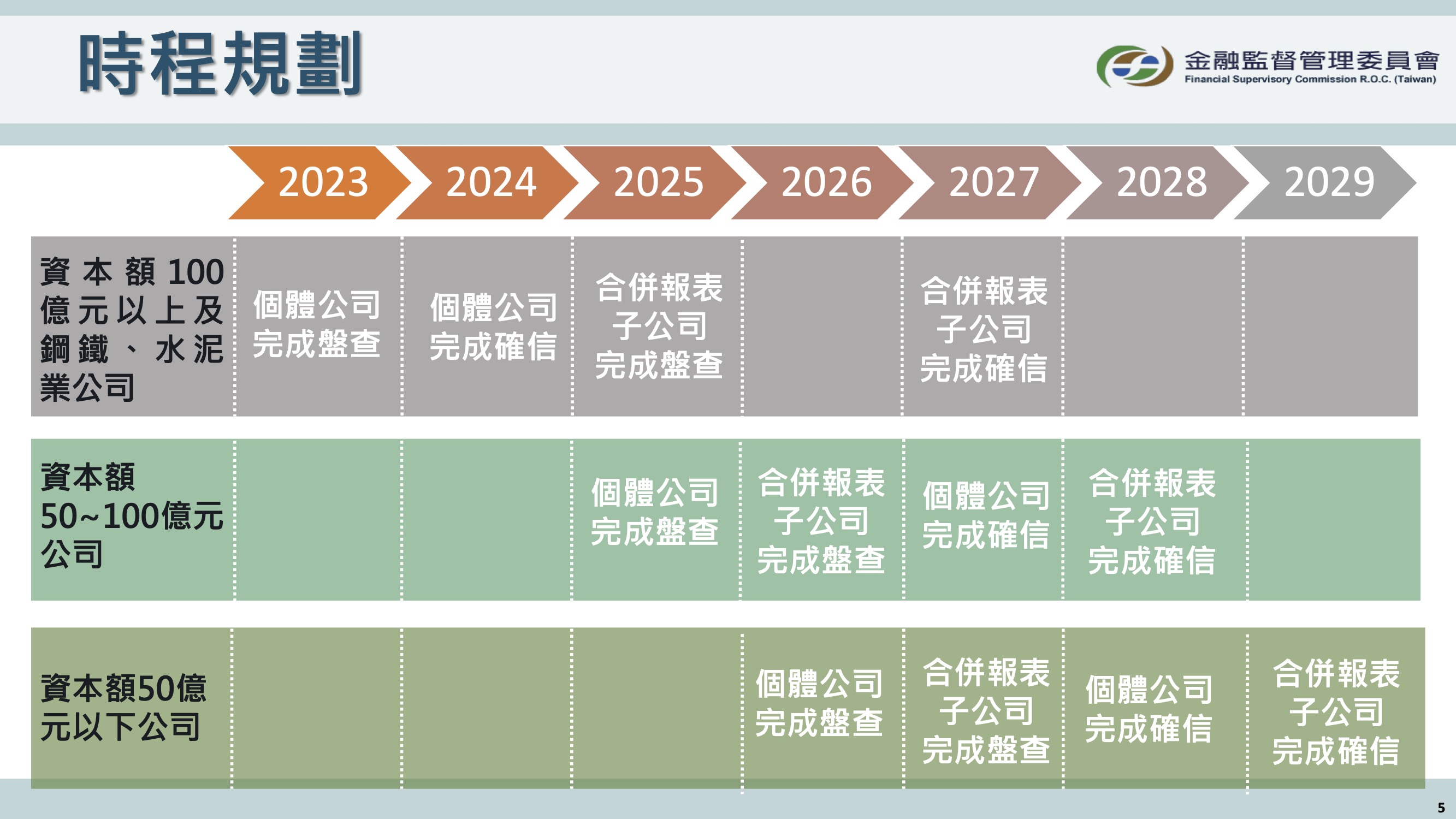

Image source: Financial Supervisory Commission

2. Core Disclosure Requirements in Financial Reporting

2.1 Environmental Data Disclosure

Starting in 2025, companies will be required to disclose carbon emission data covering Scope 1 (direct emissions), Scope 2 (indirect emissions), and Scope 3 (supply chain emissions). In addition, metrics such as energy efficiency, waste management, and water resource management will also need to be disclosed. These reports must be prepared in accordance with international standards such as those set by the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB).

2.2 Specific Requirements on the Social Aspect

Social disclosures include:

- Employee Diversity: Gender ratios and gender balance among senior executives.

- Workplace Safety: Incident rates and related improvement plans.

- Community Contribution: Level of participation in public welfare activities and their outcomes.

Disclosing such information not only reflects a company’s commitment to corporate social responsibility but also helps enhance its brand image.

2.3 Transparency in Corporate Governance

Companies must improve transparency in their governance structures, including:

- Board Composition and Diversity

- Implementation of Anti-Corruption Policies

- Mechanisms for Protecting Shareholder Rights

Image source: Pexels

3. Additional Requirements for Carbon Report Disclosures

With the global push toward carbon neutrality, carbon reports have become a key component of ESG disclosures. The Taiwanese government has clearly mandated companies to submit carbon emission-related reports, with a focus on the following:

- Carbon Audits and Calculations: Conducted according to ISO 14064 standards, covering emissions from manufacturing to the entire supply chain.

- Emission Reduction Actions and Outcomes: Disclosure of concrete measures and progress in applying emission-reducing technologies and transitioning to cleaner energy.

- Carbon Neutrality Targets: A clear timeline and roadmap toward achieving carbon neutrality must be presented.

4. Challenges and Opportunities in Regulatory Compliance

4.1 Potential Challenges in Meeting Regulations

Taiwanese companies—especially small and medium-sized enterprises—may face the following obstacles when adapting to new regulations:

- Lack of resources and expertise

- Complexity in data collection and management

- Increased financial burden

4.2 Capturing the Long-Term Value of ESG

Despite short-term difficulties, ESG compliance brings many long-term benefits, including:

- Enhanced competitiveness in the international market

- Greater access to sustainable investment opportunities

- Increased value in supply chain partnerships

Taking Delta Electronics as an example, the company has proactively implemented an energy transition strategy, pledging to achieve RE100 by 2030 and net-zero emissions by 2050. Through smart manufacturing and internal carbon pricing mechanisms, Delta has not only reduced its operational carbon footprint but also provided low-carbon solutions to key global clients, meeting the growing demand for a sustainable supply chain.Additionally, by strategically procuring green electricity worldwide and enhancing the market value of its low-carbon products, the company has further reduced regulatory risks and strengthened its brand competitiveness.

These strategies not only help Delta achieve its ESG goals but also open up greater business opportunities in international markets, positioning it as a leading enterprise in the global carbon neutrality movement.

* Sources: 專訪台達永續長 – 周志宏Jesse Chou先生 ESG總舵手 致力邁向台達永續目標

These strategies not only help Delta achieve its ESG goals but also open up greater business opportunities in international markets, positioning it as a leading enterprise in the global carbon neutrality movement.

* Sources: 專訪台達永續長 – 周志宏Jesse Chou先生 ESG總舵手 致力邁向台達永續目標

Image source: Pexels

5. Recommendations

Based on the requirements of Taiwan’s 2025 ESG regulations, the following recommendations can help companies comply effectively and enhance their sustainability performance:

- Gradually build an internal data management system: Ensure the accuracy and continuous updating of data related to carbon emissions, energy consumption, and other key sustainability metrics.

- Adopt international standards: Utilize globally recognized frameworks such as GRI or SASB for financial and carbon reporting.

- Develop a long-term sustainability strategy: Integrate ESG into the company’s core business strategy to avoid short-term actions taken merely for regulatory compliance.

- Actively leverage government resources: Take advantage of initiatives such as the Ministry of Economic Affairs’ Corporate Net-Zero Action Manual and subsidy programs to support small and medium-sized enterprises (SMEs).

6. Conclusion

The implementation of ESG regulations in 2025 presents not only a significant challenge for Taiwanese enterprises but also a crucial opportunity to advance toward sustainable operations. With proper strategic planning and professional support, companies can go beyond compliance and build core competitiveness rooted in sustainable development.

Is your company ready to meet the new ESG challenges?

Hall Chadwick Taiwan has extensive experience in ESG financial consulting and can assist your company in building a sustainability reporting framework that aligns with the latest regulatory requirements.

If you have any questions regarding the 2025 ESG financial disclosure requirements, feel free to contact us.

*Note: All data and regulations cited in this article are sourced from the official publications of Taiwan’s Financial Supervisory Commission (FSC) and the Ministry of Economic Affairs, such as the “公司治理3.0-永續發展藍圖” and the “企業永續報告準則” ensuring the authority and accuracy of the content.

If you have any questions regarding the 2025 ESG financial disclosure requirements, feel free to contact us.

*Note: All data and regulations cited in this article are sourced from the official publications of Taiwan’s Financial Supervisory Commission (FSC) and the Ministry of Economic Affairs, such as the “公司治理3.0-永續發展藍圖” and the “企業永續報告準則” ensuring the authority and accuracy of the content.